One sort of capital-raising activity within the cryptocurrency world is blockchain’s initial coin offering (ICO). Cryptocurrency and blockchain technology has shown remarkable growth over the past few years and the 2020 pandemic came as a blessing to the industry. In a time when all the businesses failed and markets were collapsing, cryptocurrencies became a blessing for many. Today the global crypto market cap has reached $1.79 trillion.

It was a new beginning for a market that will open up endless possibilities for millions soon. Today, the number of crypto and blockchain start-ups or companies across the world earning revenue in millions is astonishing. However, it not only requires years of R&D to start a crypto project but also a handsome amount of capital. This is where the Initial Coin Offering or blockchain ICO comes in.

What is Initial Coin Offering (ICO)?

Blockchain ICO is one of the best-found ways to raise capital for cryptocurrency or blockchain projects. An initial coin offering is when a blockchain-based firm creates a specific number of its native digital tokens and makes them available to early investors, usually in return for other cryptocurrencies like Ethereum or Bitcoin.

Blockchain ICOs, a kind of digital crowdfunding, allow companies to create a community of motivated consumers who want to see their project flourish so their presale tokens increase in value, in addition to raising money without giving up stock.

While ICOs can provide entrepreneurs with a novel means of raising capital and a simple funding method, buyers can also gain from increased token value if the platform is successful in addition to receiving access to the service that the token grants.

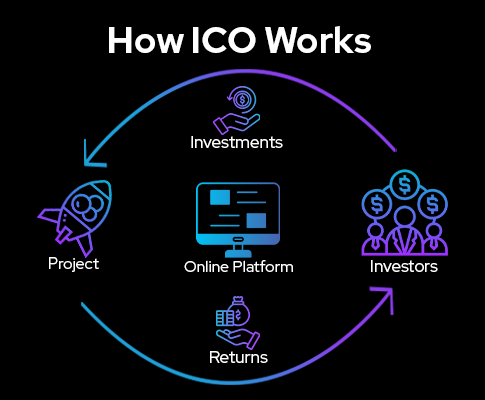

How does ICO Work?

Benefits of ICO

This was a goldmine in a world where early-stage investment faces severe barriers to enter the market, especially in an industry like cryptocurrency. Below are some of the many benefits of ICOs.

Liquidity

Lack of liquidity is a common barrier for those searching for new investing opportunities. Many times, capital is unavailable for several years. Investors in initial coin offerings have access to substantial liquidity, and because of the secondary market, real-time pricing is determined by the project's current value.

Decentralisation

Anyone can access ICOs, especially if the ICO accepts cryptocurrencies. Most initial coin offerings merely require contributors to be able to transfer funds in time for the purchase. The concept of decentralisation is something that attracts more investors as it is free from the scrutiny of any central or state authority.

Fairness

Contributors can invest at any moment with ICOs, in addition to the fact that anyone can invest. This is not the case with traditional startup fundraising processes, where being an early investor is nearly impossible unless you have a strong relationship with one of the founders. Therefore, it provides an opportunity for all.

Lower Competition

Many projects, especially those that are unappealing for some reason, have difficulty obtaining finance through conventional markets and channels. Sometimes this is just a matter of geography (the project is located outside of a major hub of wealth, for instance) or the nature of the offering. ICOs' straightforward funding processes make it possible for any initiative to get funding.

Types of ICOs

Today, ICOs are not a new concept anymore. The primary benefit of ICOs is their ability to cut out middlemen and establish a direct line of communication between the company and potential investors. Furthermore, both sides' interests coincide in an ICO.

Private ICOs

Only a select group of investors can participate in private initial coin offerings. Private initial coin offerings (ICOs) are typically restricted to approved investors, who include wealthy individuals and financial institutions. Companies also have the option to establish a minimum investment amount.

Public ICOs

Public initial coin offerings are a type of crowdsourcing that is intended for a wider audience. Due to the ease with which one can become an investor, the public offering has democratized investment. In contrast to public sales, private initial coin offerings are becoming a more attractive choice because of regulatory issues.

ICO Regulations

In the realm of finance and technology, initial coin offerings are still a comparatively new phenomenon. The recent emergence of ICOs has had a notable impact on capital-raising procedures. Regulatory bodies worldwide, however, were unprepared for the launch of the new finance fundraising model.

With heightened awareness came heightened scrutiny and questions over the legitimacy of token sales. This was made clear when the U.S. Securities and Exchange Commission (SEC) issued a warning in 2017 declaring that a digital asset sold to American investors had to comply with U.S. securities laws. Otherwise, they would risk punitive action if it possessed features similar to those of security, such as ownership rights, an income stream, or even the expectation of profit from the labours of others.

Conclusion

As more investors become aware of the advantages that ICOs present, more of them are searching for ventures to fund. When thinking about an ICO, keep in mind the benefits for investors and your firm if you're looking for a way to raise money for your idea.

ICOs have come a long way and still have a long way to go. However, before taking part, investors who want to invest in ICOs should educate themselves on cryptocurrencies and the ins and outs of ICOs. Considering how little regulation there is for initial coin offerings, potential investors should proceed with utmost caution.

Having said that, ICOs make the fundraising cakewalk for business. However, the first thing that one has to do to launch an ICO is to write the Whitepaper of the project. It is an important part of a successful ICO. The whitepaper acts as a guide for the investors to understand the project or business so that they can make a fair decision on where to invest their money.